Property Records Search

Ownership History, Mortgage Records, Purchase History, Value & Assessment & More!

What Information is Available in Property Reports?

Owner Information

Discover all the current and previous Owners, their Contact information; Email Address, Phone Number, Full Name or Company Name, and other Public Records. Our search tool gathers data from thousands of different databases.

Property Details

Get to know everything about a property, such as square footage, acreage, building area, parking or garage access, foundation, flooring, roof framing, electricity, water supply, number of stories, building style, number of units and more.

Property Value

See a property’s calculated Total Value, Land Value, Improvement Value, Assessed Value, Market Value within seconds, then use this valuable information to make the right decision. It can’t get easier than this! Just use our lookup tool.

Mortgage Records

Know any given property’s Mortgage details, such as mortgage Amount, Deed Type, Date, Loan Type, Lender name, Lender code, Term code, Due Date, second Mortgage Loan, second Mortgage Amount, and second mortgage Deed Type.

Property Sales Records

Access all past sales of the Property, dates and amounts for each transaction. With a few clicks of the mouse you can spot your future home’s sale prices over the years, buyer’s names and the historic values. Now you can make the right decision.

Judgments & Foreclosures

Are there any liens linked to the property? Has it been foreclosed? Court judgments and connected facts about any given property are at your fingertips. Our online search tool provides them in a simple yet documented section right on your screen.

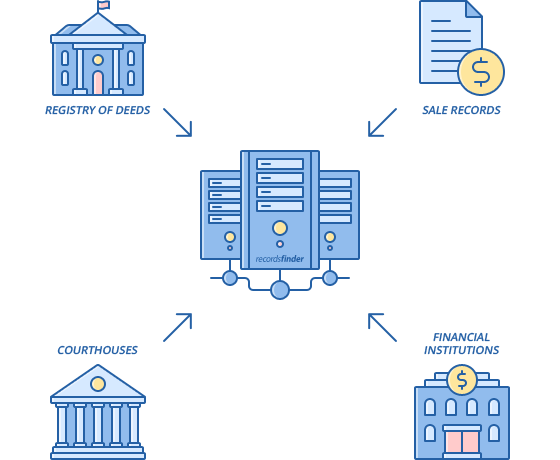

What are Property Records?

Property records refer to public information or legal documents about real estate transfers and transactions. The term “Property records” can also strictly refer to the deed that indicates the legal owner. In general, property records are being kept by the Registry of Deeds and provide specifics about plots of land or buildings, such as Address, Value, Liens, and Ownership History. Each time a property is transferred from one person to another, it’s officially recorded with the county records department.

Any type of property transfer, purchase, sale, whether they’re transmitted through a will or as a gift, as well as encumbrances or liens on the title – all this data is ready to be disclosed by Property Records. They can be consulted for various reasons: disputes over the chain of title, resolving outstanding lien problems, sharing inheritances, mortgage issues, solving boundary lines disagreements. Due to data digitalization, now you can perform a property title search online, with just a few clicks and find out who is the legal owner of a property.

Why Choose RecordsFinder.com?

Fast

Search over 2 billion records instantly. Easily find the information you are looking for with three easy steps- search, sign up, and view report.

Comprehensive

We have one of the most comprehensive data coverages in the industry including state, federal, county, municipal, and private data sources when available.

Affordable

With our unlimited search access, you can look up as many reports as you want! Others charge for every single search.

Reliable

Millions of users rely on us to deliver accurate and current data for their information needs.

Search Property Records on RecordsFinder.com

The information on this website is taken from records made available by state and local law enforcement departments, courts, city and town halls, and other public and private sources. You may be shocked by the information found in your search reports. Please search responsibly.

Recordsfinder.com is not a “consumer reporting agency” and does not supply “consumer reports” as those terms are defined by the Fair Credit Reporting Act (FCRA). Pursuant to our Terms of Service and Privacy Policy, you acknowledge and agree not to use any information gathered through Recordsfinder.com for any purpose under the FCRA, including but not limited to evaluating eligibility for personal credit, insurance, employment, or tenancy.

Searches of license plate and VIN information are available only for purposes authorized by the Driver’s Privacy Protection Act of 1994 (DPPA).

By clicking “I Agree” you consent to our Terms of Service, agree not to use the information provided by Recordsfinder.com for any unlawful purposes, and you understand that we cannot confirm that information provided below is accurate or complete.

The search you are about to conduct on this website is a people search to find initial results of the search subject. You understand that any search reports offered from this website will only be generated with the purchase of the report or account registration.